As businesses grow, financial visibility often becomes fragmented rather than clearer. What once could be tracked in a single spreadsheet gradually spreads across multiple bank accounts, payment platforms, expense tools, and reporting systems.

This fragmentation makes it harder for leaders to understand their true financial position at any given moment. Delayed insights can lead to cautious decision-making, missed opportunities, or unnecessary risk-taking based on incomplete data.

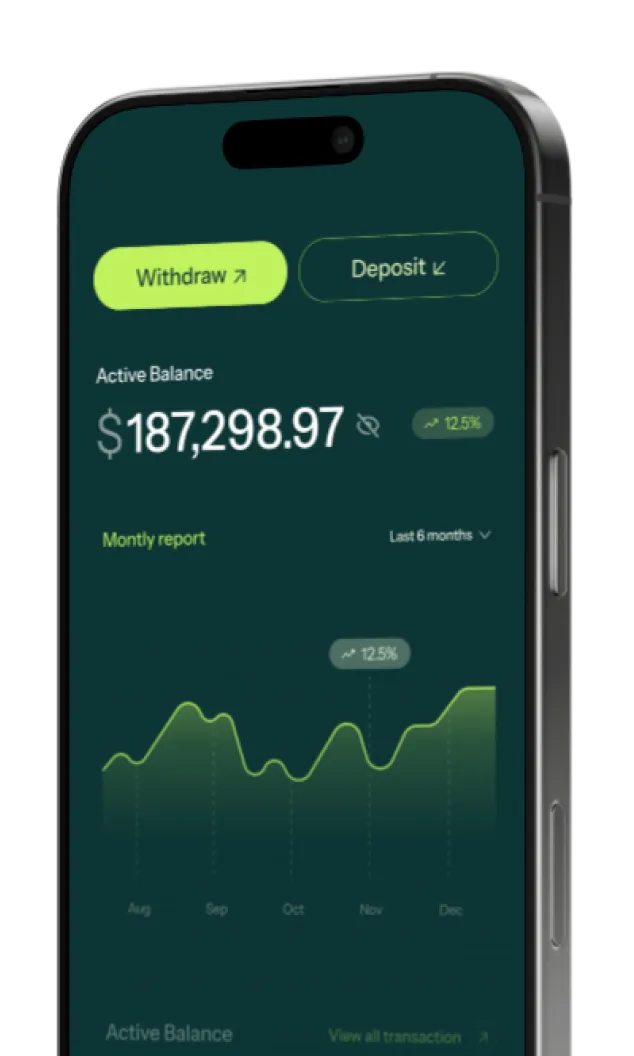

Modern financial platforms are reshaping this reality by consolidating financial activity into a unified view. Instead of reacting to month-end reports, business owners can see cash flow trends, spending patterns, and savings performance in real time. This shift fundamentally changes how finance supports growth.

Modern financial platforms are reshaping this reality by consolidating financial activity into a unified view. Instead of reacting to month-end reports, business owners can see cash flow trends, spending patterns, and savings performance in real time. This shift fundamentally changes how finance supports growth.

Decisions become proactive rather than reactive, grounded in up-to-date information rather than assumptions.

Financial visibility is no longer just about knowing where money has gone.

It is about understanding how financial behavior today impacts future outcomes. With the right tools, growing businesses can turn clarity into confidence and move forward with greater control over their financial direction.